Best Fixed Deposit Interest Rates

In this article, I will enlighten you on best-fixed deposit rates in Kenya. A fixed deposit is the most popular way of saving money. It is a sure investment as well as offers good returns.

While opening a fixed deposit account, you will need to put a fixed tenure at an agreed rate of interest. At the end of this tenure, you will receive the amount you have invested plus compound interest.

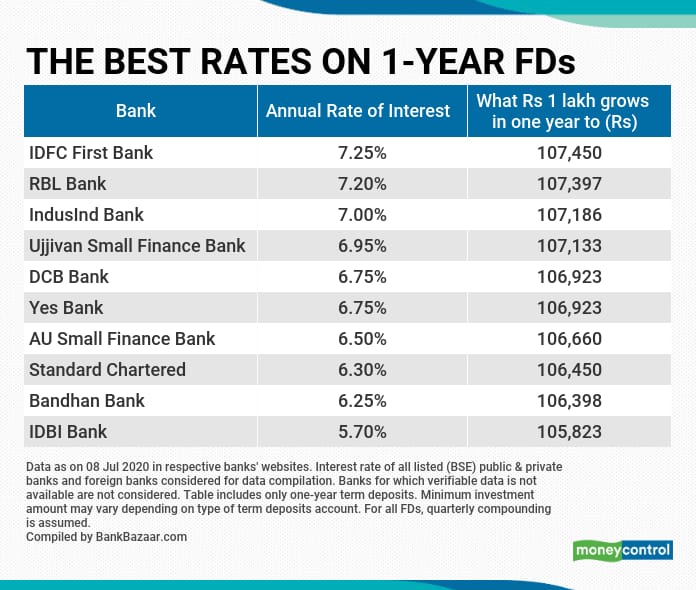

Below is the list of banks that provide best FD interest rates for 1 year to 5-year tenure. IndusInd Bank is the topmost bank for 1 year FD as it offers the highest interest rate of 7.00% on deposits of this tenure. For 5 year FD, Jana Small Finance Bank provides the maximum rate of interest which is 7.00%. We've now got fixed deposits too! FD Interest Rates up to 7.5%: Top 10 banks offering the highest interest rates on fixed deposits. By: Sanjeev Sinha December 17, 2020 10:15 AM. IDFC Bank offers the highest FD interest rate of 5.75% p.a. Which is for a tenure of 500 days for the general public. For senior citizens, the interest rate is 0.50% more. The next highest interest rate being offered is 5.50% p.a. For a tenure of up to 5 to 10 years and is being offered by ICICI Bank, HDFC Bank and Axis Bank.

- All data sourced from Economic Times Intelligence Group (ETIG) Data as on Feb 25, 2021. Interest payments; The interest rate offered on fixed deposits (FDs) will depend on the period for which you are investing in the FD and also vary from bank to bank for FDs for the same tenure.

- Best bank rates on tax-saving fixed deposits for 2021, compare which bank gives the highest interest rate under the section 80C tax deduction benefit. Check here the list of banks and the offered interest rates.

With a fixed deposit account, you are guaranteed of positive returns. These returns do not fluctuate over time as opposed to market-led investments.

Even though the fixed deposit rate falls, you will continue to receive the interest decided when you opened the account.

The return on investment on fixed deposit accounts depends on the fixed deposit interest rate and the type of deposit you are investing.

You can opt for a monthly or quarterly pay-out of interest or the reinvestment option, which will give you the benefit of compounding.

While fixed deposit accounts are fixed for an agreed tenure/period, you can take out a loan against it in the form of an overdraft.

The benefit of this kind of loan is that your investment continues to earn interest and you do not have to withdraw your money prematurely.

Best Fixed Deposit Rates in Kenya

Here are the best Fixed Deposit Rates in Kenya in 2020

1. KCB Bank

KCB offers a competitive fixed deposit rate for local and foreign currencies.

The bank, however, has a condition, money must remain in the fixed deposit rate account for the agreed period.

They offer an interest rate of up to 6% p.a. on your savings

2. I&M Bank

Fixed deposit accounts in I&M Bank are opened for fixed contracted periods, which range from one month to one year.

The bank boasts of having attractive rates, thus providing customers with long term savings growth opportunities.

Fixed deposit accounts can be opened in the following currencies,

- Kenya Shillings

- US Dollars

- Euro

- GB Pounds

- South African Rand

In I&M Bank, the minimum you are allowed to deposit for your fixed deposit account is Ksh. 50,000

3. CBA Bank

CBA bank fixed deposit account offers flexible investment periods with interest that is paid upon maturity or at predetermined times of the year.

In CBA, you have the luxury of investing in both local or foreign currency.

You require the minimum of Ksh 100,000 / USD 10,000 as the deposit amount in CBA.

4. Stanbic Bank

Interest rates at Stanbic bank are fixed during the investment period and funds available on maturity.

There is no monthly fee charged to this account, and interest is also calculated upon maturity.

5. Standard Chartered Bank

The fixed deposit account is available to clients of this bank in Kenya Shillings, US Dollar, Pound Sterling, Euro, Japanese Yen, Australian Dollar and South Africa Rand.

What is attractive about this bank is that you can negotiate for a fixed deposit rate that suits you.

You can access personal loans and overdrafts equivalent to 80% of the balance in the Fixed Deposit Account.

You require a minimum of deposit of Ksh 100,000

5. Equity Bank

Equity Bank fixed deposit account provides you with a medium for investment opportunities for individual savers, businesses and organisations.

The minimum amount you can invest in this bank is Ksh 20,000 with a minimum investment period of one month.

The bank allows you to negotiate the fixed deposit interest rate that best suits you.

One of the benefits of the fixed deposit rate accounts in this bank is that you can withdraw prematurely.

It also allows direct borrowing of up to 80%.

6. Cooperative Bank

The investment period offered by Coop Bank is one to twelve months.

The clients are then paid a competitive rate for the period the money is held in the account.

7. DTB Bank

The minimum deposit allowed at this bank is Ksh 100,000, and it offers a competitive fixed deposit rate.

You can also deposit using foreign currency–> USD 10,000 or GBP 10,000

8. Consolidated Bank

This facility is available to both individuals and business clients.

You require a minimum account opening balance of Ksh 50,000.

You can invest at this bank for a period one month, 2, 3, 6, 9 or 12 months or on call.

The account holder can get a loan and overdraft using the deposit account.

More about the fixed deposit rates in Kenya

Best Fixed Deposit Interest Rates In Malaysia

- The interest rate is fixed and guaranteed for the term of the investment, so you don`t have to worry about declining interest rates.

- Depending on what bank you settle on, interest payment options are flexible, allowing interest to be paid monthly, quarterly, half-yearly, annually or upon maturity.

- Some banks will enable you to the fixed deposit accounts as security against a loan or overdraft.

- You have the choice of changing your investment period, inform the bank before the date of maturity.

- Some banks offer a free advice slip in the mail upon maturity or on request, also enquire about this from your respective bank.