Edward Jones Cd Rates

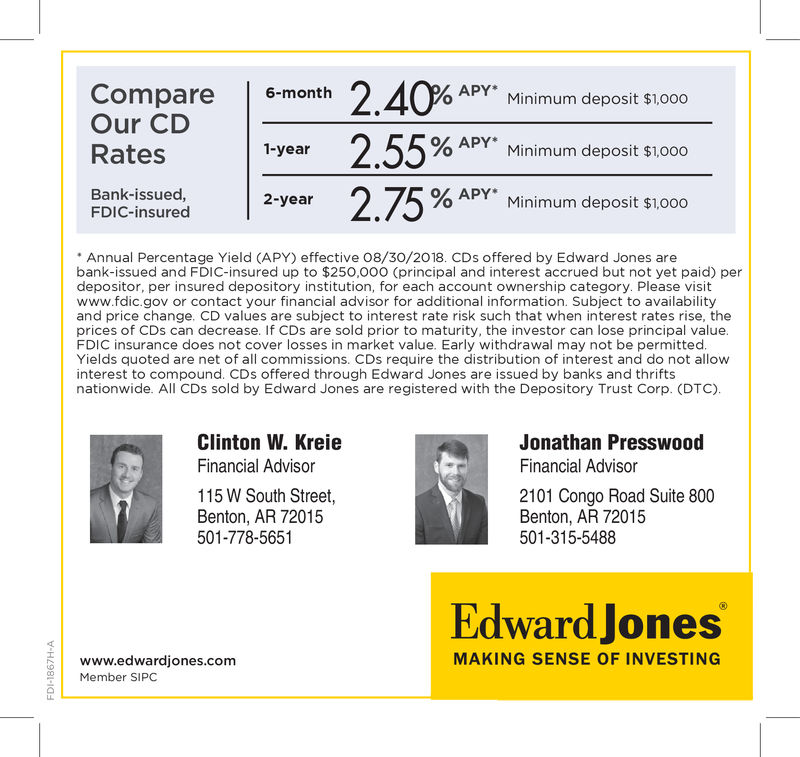

Best CD Rates in Missouri, MO - February 21, 2021. BestCashCow tracks rates for over 15,000 banks and credit unions. The rates shown here were correct when last reported to us. However, reports have become irregular due to the virus. Rates are also declining quickly due to economic circumstances. We offer very competitive interest rates, our certificates of deposit (CDs) are FDIC-insured and we have a wide selection of maturity dates and interest payment options. But unlike a bank, at Edward Jones you also get advice and guidance from your personal financial advisor on how CDs fit into your portfolio and your overall financial strategy.

© Alyssa Powell/Business Insider Alyssa Powell/Business InsiderEdward Jones commission schedule, fee structure for 2021. Investing annual management rates, account transaction cost, advisor compensation. Spirit Of Texas Bank 4 Banks & Credit Unions. 4151 Southwest Fwy. West University.

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, but our reporting and recommendations are always independent and objective.

Popular Searches

Here are the best CD rates right now:

CD terms range from 3 months up to 10 years with deposit minimums $1000 for all term types. Please check with Edward Jones for availability in your state. At Edward Jones you can build a CD ladder so as a CD matures and you can buy the next rung on your ladder with local financial advisers available to help with a EJ laddering strategy.

- Ally Bank: Best CD rates overall

- Ally Bank: Best CD rate for 1-year term

- Discover Bank: Best CD rate for 3-year term

- CIT Bank: Best CD rate for 5-year term

- Ally Bank: Best CD rate for a low minimum deposit/high APY

- Marcus by Goldman Sachs: Best rate for no-penalty CD

- Need more information? Scroll down to read more on how and why we chose the winners and what you should know about each of our picks.

If you want to grow your money but keep it safe from the turbulence of the stock market, a certificate of deposit (CD) may be a good option.

Generally, a CD should be fee-free and as easy to open as any checking or savings account. Since you're locking in an interest rate, it's smart to look for the highest one. But it's also important to consider minimum deposit requirements and penalties for early withdrawals in case you need the money in a pinch.

Below you'll find our picks for the best CD rates right now. There's no CD that will work for everyone, but we combed through offerings at around a dozen national banks as well as popular comparison sites, like Bankrate and NerdWallet, to find the strongest options available right now.

© BI BIAlly Bank: Best CD rates overall

Why it stands out: Ally has more options for CDs than any other online bank, including an 11-month, no-penalty CD with various interest rates for different balance tiers and a variable-rate CD.

Term options: Ally offers a total of 11 different CD term lengths ranging from 3 months to 5 years.

Best rates:

- 1.50% on a 1-year CD, no minimum; 1.60% on an 18-month CD, no minimum

- 1.55% on a 3-year CD, no minimum; 1.50% on a 2-year or 4-year Raise Your Rate CD

- 1.60% on a 5-year CD, no minimum

- 1.65% on a 15-month CD, no minimum. The 15-month CD is a promotional offer. Open your account by July 31, 2020, and it will automatically renew as a 1-year CD at the end of the 15-month term.

Penalties: Ally offers standard penalties for early withdrawals of your principal balance, as follows:

- 60 days interest penalty for a CD term of 24 months or less

- 90 days interest penalty for a CD term of 25 months to 36 months

- 120 days interest penalty for a CD term of 37 months to 48 months

- 150 days interest penalty for a CD term of 49 months or more

Keep an eye out for: Types of CDs. Ally offers three types of CDs: High Yield CDs, Raise Your Rate CDs, and No Penalty CDs.

Unlike regular High Yield CDs, Raise Your Rate accounts offer 2-year and 4-year terms. APRs on these accounts start lower than High Yield CDs rates, but you can increase your APR once over 2 years or twice over 4 years.

No Penalty CDs do not penalize you for early withdrawal, but the APR varies depending on the amount you initially deposit.

Be sure to choose the type of CD that makes sense for you.

© BI BIAlly Bank: Best CD rate for 1-year term

Why it stands out: Ally currently offers the best rate for 1-year CDs. There is no required initial deposit or minimum account balance. Ally's early withdrawal fees are low compared to what similar banks charge.

Rate: 1.50% on a 1-year CD.

Penalty: If you withdraw funds early from a 1-year CD, you'll pay 60 days interest on the amount withdrawn.

Keep an eye out for: Types of CDs. The Ally 1-year High Yield CD may meet your savings needs, but you might discover that another CD is a better fit.

Ally offers three types of CDs: High Yield CDs, Raise Your Rate CDs, and No Penalty CDs.

Unlike regular High Yield CDs, Raise Your Rate accounts offer 2-year and 4-year terms. APRs on these accounts start lower than High Yield CD rates, but you can increase your APR once over 2 years or twice over 4 years.

No Penalty CDs do not penalize you for early withdrawal, but the APR varies depending on the amount you initially deposit.

© BI BIDiscover Bank: Best CD rate for 3-year term

Why it stands out: You can make your deposit now or later when you apply to open a CD at Discover Bank. The minimum balance requirement is $2,500.

Rate: 1.60% on a 3-year CD, minimum $2,500 balance.

Penalty: The penalty for early withdrawal is equal to 180 days of interest.

Keep an eye out for: The minimum balance requirement. You need to be comfortable putting away at least $2,500 for 3 years.

© BI BICIT Bank: Best CD rate for 5-year term

Why it stands out: CIT Bank currently offers the best rate for 5-year CDs. The bank is known for offering a wide range of CD types, so if you decide the 5-year term isn't a good fit, you'll have plenty of other options with competitive rates.

Rate: 1.70% on a 5-year CD.

Penalty: If you withdraw early from your 5-year CD, you'll pay a penalty of 12 months of interest on the amount withdrawn.

Keep an eye out for: Minimum opening deposit. You must have at least $1,000 to open a CD with CIT Bank.

© BI BIAlly Bank: Best CD rate for a low minimum deposit/high APY

Why it stands out: You can open a CD at Ally with $0 down and still earn a competitive rate. The early withdrawal penalty is low compared to what similar banks charge.

Rate: Ally offers a total of 11 different CD term lengths ranging from 3 months to 5 years.

Best rates:

- 1.50% on a 1-year CD, no minimum; 1.60% on an 18-month CD, no minimum

- 1.55% on a 3-year CD, no minimum; 1.50% on a 2-year or 4-year Raise Your Rate CD

- 1.60% on a 5-year CD, no minimum

- 1.65% on a 15-month CD, no minimum. The 15-month CD is a promotional offer. Open your account by July 31, 2020, and it will automatically renew as a 1-year CD at the end of the 15-month term.

Penalty: Ally offers standard penalties for early withdrawals of your principal balance, as follows:

- 60 days interest penalty for a CD term of 24 months or less

- 90 days interest penalty for a CD term of 25 months to 36 months

- 120 days interest penalty for a CD term of 37 months to 48 months

- 150 days interest penalty for a CD term of 49 months or more

Keep an eye out for: Types of CDs. Ally offers three types of CDs: High Yield CDs, Raise Your Rate CDs, and No Penalty CDs.

Unlike regular High Yield CDs, Raise Your Rate accounts offer 2-year and 4-year terms. APRs on these accounts start lower than High Yield CDs rates, but you can increase your APR once over 2 years or twice over 4 years.

No Penalty CDs do not penalize you for early withdrawal, but the APR varies depending on the amount you initially deposit.

Be sure to choose the type of CD that makes sense for you.

© BI BI

© BI BI Marcus by Goldman Sachs: Best rate for no-penalty CD

Why it stands out: Marcus by Goldman Sachs offers 3 different terms for its no-penalty CD, which allows you to withdraw your total balance at any time during the term beginning one week after funding.

Rates: 1.35% on a 13-month, no-penalty CD; 1.45% on an 11-month, no-penalty CD; 1.55% on a 7-month, no-penalty CD. Minimum deposit requirement for all terms is $500.

Edward Jones Cd Rates September 2019

Penalty: None.

Keep an eye out for: The minimum deposit requirement. You need at least $500 to open the account.

Other CDs we considered and why they didn't make the cut:

- Synchrony Bank: While Synchrony Bank's 5-year CD offers a 1.65% APY, which is higher than Ally's, it requires a $2,000 minimum deposit. Ally has no minimum deposit.

- American Express: This bank doesn't require an initial deposit, and your rate can be competitive depending on how long your term is, but American Express charges high early withdrawal penalties.

- Capital One 360: Capital One CDs require no minimum balance. Rates are competitive, but they're unique — as your term lengthens, your rate decreases. Most competitors' rates increase as your term lengthens.

- Citizens Access: Citizens Access offers high APYs on its CDs, ranging from 1.50% to 1.65%, but all terms require a minimum deposit of $5,000.

- Sallie Mae: The rates on Sallie Mae's CDs are as high as 1.35%, but the minimum deposit to open an account is $2,500 and there isn't a no-penalty CD available.

- HSBC Direct: HSBC's CD rates were relatively high, but they've dropped to 0.75% for 6-month terms and 0.80% for 1-year and 2-year terms.

- PurePoint Financial: PurePoint's rates are on par with the best CDs on our list, but its $10,000 minimum deposit could be a major drawback for more modest savers.

- Barclays: You'll earn a decent APY with Barclays, and you can start with no opening deposit. However, you do have to fund the CD within 14 days to keep it open.

- Chase Bank: While Chase has some truly excellent rewards credit cards, the rates on its CDs do not compete with any of the banks on our list.

Frequently asked questions

Beacon Credit Union Cd Rates

Why trust our recommendations?

Personal Finance Insider's mission is to help smart people make the best decisions with their money. We understand that 'best' is often subjective, so in addition to highlighting the clear benefits of a financial product or account — a high APY, for example — we outline the limitations, too. We spent hours comparing and contrasting the features and fine print of various products so you don't have to.

How did we choose the best CDs?

We reviewed CD offerings from around a dozen national banks. All banks included on our list are insured by the FDIC and do not impose monthly maintenance fees on CDs.

In the event two banks offered the same APY on a CD product, we considered minimum deposit requirements and penalties for early withdrawals.

For this list, we did not consider credit unions — though they tend to offer high interest rates on savings accounts and CDs, many limit membership to people who work in a specific industry or live in a designated area.

What is a CD?

A CD is basically a time-sensitive savings account that holds your money at a fixed interest rate for a specified period of time. You can open one at almost any bank or credit union.

If you don't need immediate access to your savings, a CD can guarantee a return on your money since you lock in a fixed annual percentage yield (APY) for the term of the CD. During that period, you typically won't be able to add additional money or access your original balance without paying a penalty.

Edward Jones Cd Rates For 5 Years

You will, however, earn interest on the amount and have the option to collect those payments monthly or reinvest them into your CD. Most banks offer varying rates for different terms and deposit amounts — typically, the longer the term, the higher the rate.

Edward Jones Cd Rates Today

At the CD's maturity date, you'll typically have a 10 to 14-day grace period in which you can withdraw your money and close the account or renew the term.

Are CDs safe?

CDs are safer than investing your money in the stock market but may be less liquid than a savings account. CDs are a good place to store and grow money that you will need at a predetermined future date. While your money doesn't have the potential to earn as much as it would in the stock market, there is no risk.

Like savings accounts, CDs are insured by the FDIC for up to $250,000.

Are CDs a good investment?

Timing matters. CDs can be a good investment if interest rates are currently high and/or expected to fall. The biggest benefit of a CD is your ability to lock in a fixed interest rate. If interest rates fall during the term of your CD, the APY on your CD will not be affected. Conversely, if rates are expected to rise, then it may not be a good time to put money in a CD.

Can you lose money in CDs?

You cannot lose money in a CD if you leave it untouched for the full term length. It is like a locked savings account and the only way you can lose money is if you make an early withdrawal for which you are penalized.

Are CD rates going up?

Interest rates on CDs follow the federal funds rate, which is determined by the Federal Reserve. Since July 2019, the Fed has reduced interest rates three times, which means rates probably won't drop for another several months, if at all.