Ing Deposit Cash

- Ing Deposit Cash Flow

- Ing Deposit Cash Australia Post

- Bank Limits On Cash Deposit

- Cash Deposit Limit

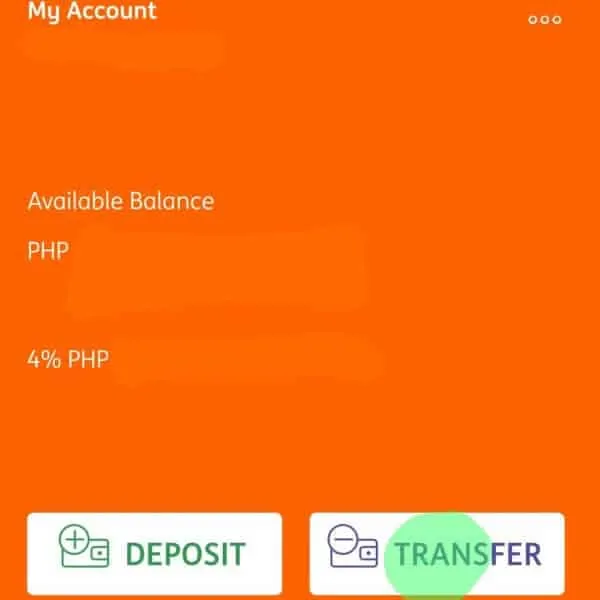

- Ing Deposit Cash Transfer

- If you have a complaint, please call us on 133 464 at any time as we have procedures in place to help resolve any issues you may have. Deposit and savings products are issued by ING, a business name of ING Bank (Australia) Limited ABN 24 000 893 292 AFSL 229823.

- Once you deposit the cash, you can use the money to make purchases at stores, pay any bills with its online billpay, or transfer the money to a linked bank account. Say No To Management Fees If you are paying an advisor a percentage of your assets, you are paying 5-10x too much.

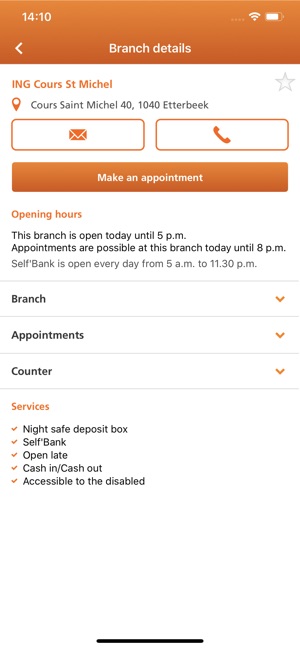

Visit a Self'Bank with a Cash In/Cash Out terminal; Choose the 'deposit cash' option. Select the ING account you would like be credited (current account or savings account). Insert your banknotes into the slot and follow the instructions. You can deposit up to 120 notes at a time. The amount deposited is calculated immediately and appears on. The Ingo Money App may be used by identity-verified customers to cash checks issued on U.S. Financial accounts to fund: (1) most debit, prepaid and credit card accounts issued by hundreds of U.S. Financial institutions including Chase ®, Bank of America ®, Citi ®, Wells Fargo ®, American Express ®, U.S. Bank ®, PNC Bank ®, Capital One ®, HSBC Bank USA, TD Bank, Discover ®, Synchrony.

Do you use an online checking account such as Ally, Capital One 360, USAA, Fidelity, or Schwab? If you do, here’s a challenge:

How do you deposit cash to it?

Ing Deposit Cash Flow

Deposit at least $1,000 from an external bank account to any personal ING account in your name (excluding Living Super and Orange One),. Also make at least 5 card purchases that are settled (and not at a 'pending status') using your ING debit or credit card (excluding ATM withdrawals, balance enquiries, cash advances and EFTPOS cash out only transactions).

It would be cheating if you first deposit the cash to a local, brick-and-mortar bank and then transfer it to your online bank. In that case you are not really depositing to your online bank. It also means you have to maintain a local, brick-and-mortar bank account.

It’s very easy to deposit a check to an online bank account. If you are not in a hurry and if you trust the Postal Service, you can just mail it. Many online banks also offer remote deposit by smartphone or computer scanner. USAA accepts check deposits at UPS Stores. Fidelity takes checks at their local offices.

Depositing CASH? Not so easy. You know you are not supposed to send cash by mail. UPS Stores don’t accept cash deposit for USAA. Fidelity’s local offices don’t take cash either. Take a picture of the cash with your smartphone? Good try.

Buy a money order and then do the deposit by mobile phone? First, a money order costs money. Second, you want to check to see if the mobile deposit app accepts money orders. Mobile apps from Ally, Capital One 360, and Fidelity all don’t accept money orders.

I recently had to deposit some cash. I used this state-of-the-art device that sits outside our cafeteria at work. It took my cash, counted the bills, deposited it, and then gave me a receipt. All done in less than 1 minute.

Wait, did I say online account? Yes, I use Alliant Credit Union*. There is no branch near me. Alliant Credit Union contracts with several ATM networks. Many contracted ATMs take deposits.

I use the same machine for depositing checks. It beats any mobile app by a long mile. When I tried a few mobile deposit apps, they would reject the pictures half of the time. I had to retake the pictures and resubmit, sometimes several times. Very frustrating. With the industrial-grade machine, I can feed multiple checks in one shot. It doesn’t matter whether I feed them face-up or face-down. The machine reads the front and the back and the amount on the checks in one pass. It prints a summary or thumbnail images on the back of the receipt. Beat that, iPhone app!

Ing Deposit Cash Australia Post

Among all the major online banks — Ally, Capital One 360, USAA, Fidelity, Schwab — Alliant Credit Union solves this depositing problem most elegantly.

Bluebird Account

Bank Limits On Cash Deposit

If you’d rather not switch banks, you can get a Bluebird account by American Express and deposit cash at any Walmart store. Bluebird account is an online account with no minimum balance and no monthly fee. Once you deposit the cash, you can use the money to make purchases at stores, pay any bills with its online billpay, or transfer the money to a linked bank account.

Cash Deposit Limit

Say No To Management Fees

Ing Deposit Cash Transfer

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.