Pnc Direct Deposit

The PNC Bank direct deposit authorization form is a standard method for authorizing an entity, such as an employer, to deposit payments directly to a PNC Bank Account of your choosing. Some employers may have their own forms or procedures, so it is generally recommended to check with this entity before submitting this form. The Direct Deposit Payments will occur at the pace set by the Paying Entity, thus you should make sure you are abreast of this entity’s pay schedule.

Set up direct deposit - and get access to your paycheck right away Deposit cash - at any PNC Branch 2, or participating Visa ReadyLink retail location 3 Load cash - at select PNC DepositEasy℠ ATMs using the Prepaid Load option 4. PNC Bank will never ask you for personal information via email, text message or unsolicited phone call. During the pandemic, PNC Bank encourages you to stay home and stay safe when possible. Take advantage of PNC Mobile Deposit to deposit checks up to $10,000 or deposit using a PNC ATM. FORM1 The quickest way to sign up for direct deposit – or change it – is to ask your employer for their direct deposit form, then fill it out using your new account number and routing number (see illustration below). You may be able to use this form for any non-governmental. Customers can access and apply for PNC Remote Deposit directly through PNC Online Banking. Once approved, businesses will be sent their scanner hardware. Instructions for installing your scanner and getting started are included in the Users' Guide. Sign in to PNC Online Banking. Click the Business Tools tab. The Business Tools Summary will appear. Click Enroll Now on the PNC Remote Deposit tile. This opens the How it Works page. The PNC Remote Deposit. Call PNC at 888-762-2265 and verify Login to your PNC online account, they show routing and account numbers in a link by each account PNC includes a routing number on its deposit slips, but THIS MAY NOT BE THE CORRECT ONE FOR YOUR ACCOUNT. Use the methods above to.

Step 1 – Use the “PDF” button on the right hand side of this page to download a blank copy of the PNC Bank Direct Deposit Authorization Form. If you do not have a PDF program or a form friendly browser, you will need to print this form out then fill it out manually. Two copies are provided in this PDF. This may be handy should an Employer require such forms in duplicate or you wish to keep one for your records (recommended).

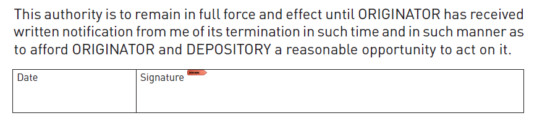

Step 2 – Under the Title locate the two check boxes, labeled “New Request” and “Change Request.” Here, you must define the reason for submitting this form. If this is a New Request and you do not have a Direct Deposit Account set up then you may choose the first box. If you do have a Direct Deposit transfer set up and wish to change your account, then select the “Change Request.”

Step 3 – Next you will need to enter your full Name in the box labeled “Name.”

Step 4 – Report your Social Security Number

Step 5 – In the Boxes labeled “Address” and “City, State, Zip Code,” enter your Full Address as it is reported with PNC Bank.

Step 6 – The next paragraph will verify your consent to allow a specific organization or company to report deposit payments directly into your account. You must report the Full Name of this Company or Organization on the blank line provided preceding the words “hereinafter called “Originator.””

Step 7 – Locate the words “Account Type” in the first row of the table titled “Primary Account.” If you prefer to use your Checking Account to receive the deposit then select the first check box. If not, then you may select the second check box to use your Savings Account to receive the Deposit. Below this, you must enter the full Account Number where the deposit should be made.

Step 8 – In the box labeled “Routing Number,” you will need to enter the Routing Number for the PNC branch where you keep your account.

Step 9 – In the box labeled “Amount to Deposit,” you may decide precisely how much of your payments will be directly deposited. If you would like the entirety of the payment to be deposited then select the check box labeled “Net Pay.” If you would like a specific amount (to be deposited) then select the second check box and enter this amount on the blank line following the dollar sign. If you wish to deposit the Full Amount into one account proceed to Step 11. If you would like to deposit funds to two Accounts whenever you are paid, then proceed to Step 10.

Step 10 – In some cases, it may be better to split the amount being paid to be deposited across two destinations. If so, you will need to report where the balance of the payment from Step 9 must be deposited. In the table labeled “Optional Secondary Account,” report the Account Type of the second Account by selecting either the check box labeled “Checking” or the check box labeled “Savings” and enter the Account Number below this. You will also need to enter the correct Routing Number for the PNC branch, where you bank, in the box labeled “Routing Number.” Finally, under the words “Amount to Deposit,” check the second box then enter the Amount to be deposited.

Step 11 – Below the Verification Paragraph, report the Date this form is being Signed in the box labeled “Date” then Sign your Name in the “Signature” box.

Step 12 – Next, you will need to submit this form to the proper Department of your place of employment. In many cases, this will be the Payroll Department however smaller companies may have unique structures. Make sure you submit this to the proper office. It is highly recommended to keep a copy for yourself.

Save

PNC Bank Routing Numbers and Wire Transfer Instructions

Quick find guide:

How do I find routing numbers?

What is a routing number?

How do I setup a direct deposit?

How do I receive money from outside the United States?

Wire Transfer Information

How much does it cost to complete a wire transfer?

How long does a transfer take?

READ MORE:LendingClub vs LendingTree personal loan review.

How do I find routing numbers?

1. Look at the bottom left of your PNC Bank paper check.

2. If you live in Lower Saxony, we've compiled a list of your essential routing numbers for PNC Bank.

ABA: See Website

ACH: See Website

Wire Transfer: See Website

SWIFT/BIC Code for USD Denominated Transfers: PNCCUS33

3. Simply visit here to view all the PNC Bank routing numbers for each routing number associated with all regions.

4. View the routing numbers on PNC Bank's website.

What is a routing number?

ABA: (American Bankers Association number), also known as a Routing Transfer Number (RTN) is a nine-digit code that normally appears on the bottom of paper checks. This routing number is used to correctly identify the issuing financial institution. ABA numbers can be the same as wire numbers, and vary from financial institution. Ensure you check with your bank that you're using the right one.

ACH: (Automatic Clearing House number) is an electronic payment delivery system primarily used for direct deposits, making payments, and collecting funds. Most employers will use this routing number when setting up direct deposits for employees pay. It can also be used for when setting up auto-pay with different companies.

Wire: Some banks will require a different routing number used for wire transfers. It can be the same as an ABA or ACH number, and varies on the issuing institution. Simply the fastest method of sending/receiving funds, unless you are using a service like Transferwise, in which funds would be transferred immediately. Money can be available in as little as one day with a wire transfer, but international wire transfers could require you to wait up to six business days. The only downfall with this payment method is that financial institutions will charge large fees associated with the quick availability of funds.

SWIFT/BIC: (Society for Worldwide Interbank Financial Telecommunication / Bank Identifier Code) is a code used to identify financial institutions worldwide. The code can be 8 or 11 digits long, and will have different parts associated with it. The first four characters identify the bank, the next two will identify the country, and the last two will identify the location. If the code is a total of 11 digits, the ending three digits will identify the branch. If the last three are XXX, this means that the SWIFT/BIC code belongs to the main branch. Anything deviating from XXX will identify a secondary or local branch.

Pnc Direct Deposit Information

BEST:BBVA Compass Bank to offer free $200 bonus on credit cards.

How do I setup a direct deposit?

In order to setup a direct deposit, you will simple need the ACH number, also known as a routing number: See Website (Lower Saxony), and your checking account number. Savings accounts can also be used for direct deposit but some banks may have limitations on these types of transactions, potentially charging you a fee for the amount of times you transfer money inbetween accounts. Many employers will have an option to allow you to setup direct deposit, instead of receiving a physical check every pay period.How do I receive money to PNC Bank from outside the United States?

In order to conduct these type of transfers, you will need to consider a wire transfer. Below are the two types of wire transfers for international use. Please note that some banks will have different receiving information for U.S. dollar and foreign denominated currency transfers.The sender will need the following information to successfully send money to your Bank of America account. Ensure the SWIFT/BIC number is given correctly to ensure there is no issue in receiving your transfer. Some banks have different SWIFT/BIC codes for foreign currency and US dollar transfers due to the conversion rate of different currencies. Also note that the cost to send a wire transfer can be substantial.International Wire Transfer Information

Use this information to receive funds internationally.| Bank Details | Values |

|---|---|

| Bank Name | PNC Bank N.A. |

| Bank Address | 222 Delaware Avenue |

| Bank City, State, and Zip | Wilmington, DE 19899 |

| SWIFT/BIC Code | PNCCUS33 |

| Lower Saxony Routing Transfer Number | |

| Beneficiary Account Number | Your complete PNC Bank account number (including leading zeros) |

| Beneficiary Name | The name of your account as it appears on your statement |

How much does it cost to complete a wire transfer?

Banks tend to charge between $10 and $30 for domestic wire transfers, and between $30 and $50 for international wire transfers. In 2018, wire transfer fees can be avoided by using services like transferwise.

Banks only charge so much because they can. Realistically, for a bank to convert money from one currency to another costs a fraction of what they charge. This is the most recommended service due to how fast it takes and the minimal fees paid. Below is a chart comparing national banks and what they charge to transfer funds internationally.

Cost to convert $1,000 into Euros to send internationally

| Bank | International Outgoing Fee |

|---|---|

| BBVA Compass | $45.00 |

| Navy Federal Credit Union | $25.00 |

| Kinetic Credit Union | Varies |

| Citizens Bank | $60.00 |

| USAA | $45.00 |

| Capital One Bank | $40.00 |

Transferwise | $8.45 |