Time Deposit Interest Rate

The post office offers several deposit schemes for investors. These investments are commonly known as small savings schemes. These schemes carry the sovereign guarantee of the Indian Government. In this post, I will discuss all about the Post Office Time Deposit Account (POTD).

Post Office Time Deposit Account (POTD)

POTD scheme is a popular investment scheme offered by the India Post. The post office term deposit is similar to the fixed deposits (FDs) provided by banks.

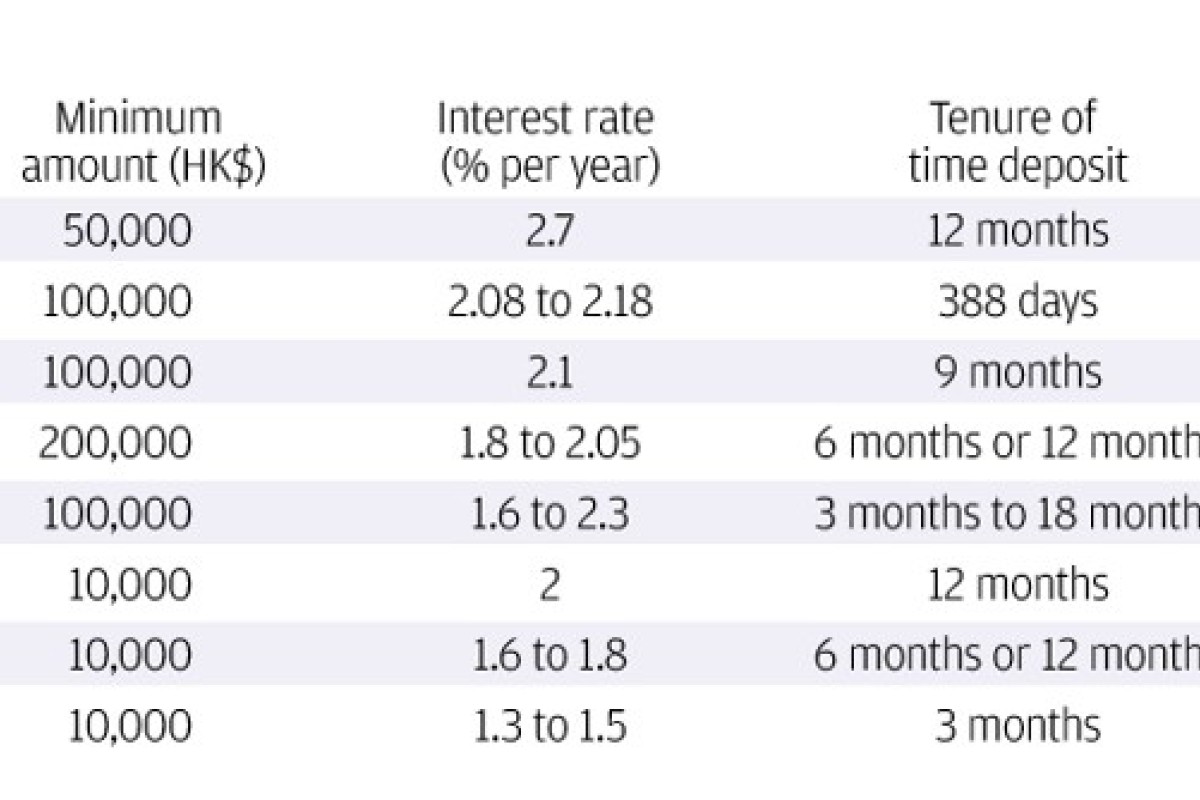

RMB New Fund Time Deposit Offers: up to 1.60% p.a. Available online; Foreign Exchange / Time Deposit New Fund Offers: Enjoy +1% p.a. Bonus rate on top of prevailing rates by converting and placing time deposit with HKD30,000 (or equivalent) or above with New Funds. (applicable to designated currency) Remark:The above interest.

In this scheme, you deposit a lump sum of money for a fixed period and earn a guaranteed return on it. The POTD scheme offers four maturities: 1 year, 2 years, 3 years, and 5 years.

Post Office Time Deposit Interest Rate

The Ministry of Finance reviews the Post Office Term Deposit Interest Rate at the beginning of every quarter of the financial year. The interest rate is decided based on the yield on government securities.

A time deposit, or a certificate of time deposit, is an interest-bearing bank deposit that has a specified date of maturity. It is a bank account type option for customers who would like to deposit available excess funds in a high-interest. Time deposits, also known as certificates of deposit, pay a much higher interest rate but require a minimum deposit and tie your money up for a set period of time, which can range. Interest rates for deposit account is for a 12 month / 1 year term and rates vary according to the following deposit amounts: from 2.500 0.10% pa from 10,000 0.20% pa.

The following interest rates apply to term deposits from April 1, 2020, to June 30, 2020.

| Account Period | Applicable Interest Rate |

| 1 Year | 5.50% |

| 2 Years | 5.50% |

| 3 Years | 5.50% |

| 5 Years | 6.70% |

Interest shall be payable annually but calculated quarterly. Note that there is no additional interest payable on the amount of interest that has become due for payment but not withdrawn by you.

The annual interest may be credited to the post office savings account of the account holder at his option.

Features & Benefits of Post Office Time Deposit Account

The following are the key features of the POTD scheme.

1. The POTD scheme offers four tenures: 1 year, 2 years, 3 years, and 5 years.

2. This scheme provides guaranteed returns on the investments for the tenure you opt for.

3. The scheme is backed by the government of India. Therefore, investment in the POTD scheme completely protected.

4. This scheme can be opened by cash or cheque. If you deposit a cheque, the date of realization of cheque in government account shall be the date of opening of TD account.

5. The minimum deposit required for opening POTD is Rs.1000 and in multiples of Rs.100. However, there is no maximum limit.

6. Only one deposit can be made in one account.

7. Nomination facility is available. You can nominate a person at the time of opening and also after opening of POTD account.

8. This account can easily transferred from one post office to another.

9. You can open any number of accounts in any post office.

10. A single account can converted into a joint and vice versa as per the need.

11. Minors after attaining the majority have to apply for conversion of the account in their name.

12. You can extend your TD by giving an application in the post office.

13. Online Account Opening facility is available through Intra Operable Netbanking/Mobile Banking.

Time Deposit Interest Rates

14. The investment in this scheme is risk-free and you will get complete returns on maturity.

Eligibility Criteria for Post Office Term Deposit Account

POTD Account may be opened by

1. A single adult

2. Joint Account with a maximum of three adults.

3. A minor aged 10 years or more.

Time Deposit Interest Rate

4. A guardian on behalf of a minor or person of unsound mind.

Tax Implications under POTD Account

The investment under 5 years term deposit qualifies for income-tax deduction under Section 80C of the Income Tax Act, 1961. However, there is no tax benefit on the investments with less than 5 years of tenure.

Premature Withdrawal of Post Office Term Deposit Account

Withdrawal of funds before the maturity called premature withdrawal. Note that premature withdrawal not allowed before the expiry of 6 months.

If you close your TD between 6 months to 12 months from the date of opening, Post Office Saving Accounts interest rate is payable.

Premature withdrawal after a year earns 1% lower than the interest rate the deposit for that specific tenure earns.

Final Thoughts

Post Office Time Deposit Account (POTD) is an alternative to Bank FDs as it offers higher interest rates. Moreover, there is no risk associated with this term deposit and you will get complete returns on maturity.

Post Office Term Deposit Account is a suitable investment option for those individuals who are ultra-conservative. Therefore, if you are a conservative investor then you may choose to invest in these schemes.

Related post: SBI PPF Account – How to open PPF Account in SBI Online

Related post: Top 15 Best Investment Options in India

Related

eCompareMo partners with the leading banks to provide you with impartial and up-to-date information on all financial products in the country. With our state-of-the-art time deposit calculator, you can compare and contrast all time deposit interest rates in the Philippines to find the best one that can give your investment a head start.

What is a time deposit?

A time deposit, or a certificate of time deposit, is an interest-bearing bank deposit that has a specified date of maturity. It is a bank account type option for customers who would like to deposit available excess funds in a high-interest account type. This is issued for a specified term, such as 30 days (minimum) up to five years. Funds can be withdrawn without prior notice, or before the maturity date, though there are penalties for early withdrawal.

Forms of deposit can be through cash, check (personal or managers check) and fund transfer from an existing account maintained at the same bank where the time deposit will be placed.

Time Deposit Interest Rate Wells Fargo

Why do I need to open a time deposit account?

The more money you invest in a time deposit, the more you'll earn. Also, with its better interest rates, one of the benefits of time deposit is it secures higher yields from your savings. Choose from any type of time deposits—traditional, mutual fund, fixed, term deposit with interim interest, flexible—and let your money grow.

How to open a time deposit account

Time Deposit Interest Rate Bank Of America

Our advanced calculation engine allows users to make a fast and easy comparison of all time deposit interest rates offered by banks in the Philippines—guaranteed free. Applicants can get detailed information, such as minimum initial placement, placement term, withholding tax, rollover allowance, certificate of time deposit, and other requirements.

After doing a comparison using eCompareMo’s time deposit interest rate calculator, you can immediately invest for a time deposit online. By using our platform, you can save time and money in choosing the right time deposit account.

To open a time deposit account, all you need is a digitized ID, such as an SSS ID, Driver’s License, Voter’s ID, Company ID, and the like.

Receive top-notch support from our customer service agents

Our customer helpdesk is more than willing to answer your questions regarding the product/s of your choice. Our highly trained agents also provide you with financial advice and other information that will help you make an informed decision about time deposit.

Data security is our top priority

Your security is paramount to us, that’s why at eCompareMo, we use global standards in data privacy and security. With an encrypted data protection system, you can be sure that all your personal information is protected. We will never share any of your data with other parties without your consent.

Deposit Account Interest Calculator

Helping millions of Filipinos save time and money

eCompareMo helps Filipinos achieve financial freedom through financial products and services. By using our service, customers can simplify their process of searching for the best products that are tailored to their wants and needs.

Aside from financial comparison services, we also provide insightful, informative, and inspirational articles as well as social media campaigns that aim to reach out to people looking for financial freedom in their lives.

With eCompareMo, opening a time deposit account in the Philippines has never been easier.